Transform retail operations with Zebra’s retail technology solutions, featuring hardware and software for improving inventory management and empowering teams.

Streamline operations with Zebra’s healthcare technology solutions, featuring hardware and software to improve staff collaboration and optimise workflows.

Enhance processes with Zebra’s manufacturing technology solutions, featuring hardware and software for automation, data analysis, and factory connectivity.

Zebra’s transportation and logistics technology solutions feature hardware and software for enhancing route planning, visibility, and automating processes.

Zebra's public sector technology solutions enhance decision-making, streamline operations, and safeguard communities with advanced software and rugged hardware.

Zebra's hospitality technology solutions equip your hotel and restaurant staff to deliver superior customer and guest service through inventory tracking and more.

Zebra's market-leading solutions and products improve customer satisfaction with a lower cost per interaction by keeping service representatives connected with colleagues, customers, management and the tools they use to satisfy customers across the supply chain.

Empower your field workers with purpose-driven mobile technology solutions to help them capture and share critical data in any environment.

Zebra's range of mobile computers equip your workforce with the devices they need from handhelds and tablets to wearables and vehicle-mounted computers.

Zebra's desktop, mobile, industrial, and portable printers for barcode labels, receipts, RFID tags and cards give you smarter ways to track and manage assets.

Zebra's 1D and 2D corded and cordless barcode scanners anticipate any scanning challenge in a variety of environments, whether retail, healthcare, T&L or manufacturing.

Zebra's extensive range of RAIN RFID readers, antennas, and printers give you consistent and accurate tracking.

Choose Zebra's reliable barcode, RFID and card supplies carefully selected to ensure high performance, print quality, durability and readability.

Zebra's rugged tablets and 2-in-1 laptops are thin and lightweight, yet rugged to work wherever you do on familiar and easy-to-use Windows or Android OS.

With Zebra's family of fixed industrial scanners and machine vision technologies, you can tailor your solutions to your environment and applications.

Zebra’s line of kiosks can meet any self-service or digital signage need, from checking prices and stock on an in-aisle store kiosk to fully-featured kiosks that can be deployed on the wall, counter, desktop or floor in a retail store, hotel, airport check-in gate, physician’s office, local government office and more.

Adapt to market shifts, enhance worker productivity and secure long-term growth with AMRs. Deploy, redeploy and optimize autonomous mobile robots with ease.

Discover Zebra’s range of accessories from chargers, communication cables to cases to help you customise your mobile device for optimal efficiency.

Zebra's environmental sensors monitor temperature-sensitive products, offering data insights on environmental conditions across industry applications.

Zebra's location technologies provide real-time tracking for your organisation to better manage and optimise your critical assets and create more efficient workflows.

Enhance frontline operations with Zebra’s AI software solutions, which optimize workflows, streamline processes, and simplify tasks for improved business outcomes.

Empower your frontline with Zebra Companion AI, offering instant, tailored insights and support to streamline operations and enhance productivity.

The everything you need to rapidly and cost effectively develop high-performance AI vision applications on Zebra mobile computers.

Zebra Workcloud, enterprise software solutions boost efficiency, cut costs, improve inventory management, simplify communication and optimize resources.

Keep labour costs low, your talent happy and your organisation compliant. Create an agile operation that can navigate unexpected schedule changes and customer demand to drive sales, satisfy customers and improve your bottom line.

Drive successful enterprise collaboration with prioritized task notifications and improved communication capabilities for easier team collaboration.

Get full visibility of your inventory and automatically pinpoint leaks across all channels.

Reduce uncertainty when you anticipate market volatility. Predict, plan and stay agile to align inventory with shifting demand.

Drive down costs while driving up employee, security, and network performance with software designed to enhance Zebra's wireless infrastructure and mobile solutions.

Explore Zebra’s printer software to integrate, manage and monitor printers easily, maximising IT resources and minimising down time.

Make the most of every stage of your scanning journey from deployment to optimisation. Zebra's barcode scanner software lets you keep devices current and adapt them to your business needs for a stronger ROI across the full lifecycle.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

Zebra DNA is the industry’s broadest suite of enterprise software that delivers an ideal experience for all during the entire lifetime of every Zebra device.

Advance your digital transformation and execute your strategic plans with the help of the right location and tracking technology.

Boost warehouse and manufacturing operations with Symmetry, an AMR software for fleet management of Autonomous Mobile Robots and streamlined automation workflows.

The Zebra Aurora suite of machine vision software enables users to solve their track-and-trace, vision inspection and industrial automation needs.

Zebra Aurora Focus brings a new level of simplicity to controlling enterprise-wide manufacturing and logistics automation solutions. With this powerful interface, it’s easy to set up, deploy and run Zebra’s Fixed Industrial Scanners and Machine Vision Smart Cameras, eliminating the need for different tools and reducing training and deployment time.

Aurora Imaging Library™, formerly Matrox Imaging Library, machine-vision software development kit (SDK) has a deep collection of tools for image capture, processing, analysis, annotation, display, and archiving. Code-level customisation starts here.

Aurora Design Assistant™, formerly Matrox Design Assistant, integrated development environment (IDE) is a flowchart-based platform for building machine vision applications, with templates to speed up development and bring solutions online quicker.

Designed for experienced programmers proficient in vision applications, Aurora Vision Library provides the same sophisticated functionality as our Aurora Vision Studio software but presented in programming language.

Aurora Vision Studio, an image processing software for machine & computer vision engineers, allows quick creation, integration & monitoring of powerful OEM vision applications.

Adding innovative tech is critical to your success, but it can be complex and disruptive. Professional Services help you accelerate adoption, and maximise productivity without affecting your workflows, business processes and finances.

Zebra's Managed Service delivers worry-free device management to ensure ultimate uptime for your Zebra Mobile Computers and Printers via dedicated experts.

Find ways you can contact Zebra Technologies’ Support, including Email and Chat, ask a technical question or initiate a Repair Request.

Zebra's Circular Economy Program helps you manage today’s challenges and plan for tomorrow with smart solutions that are good for your budget and the environment.

Maximizing Profit in Omnichannel: Where Clothing Retailers Can Adapt to Today’s Challenges

Retailers are not exactly experiencing the best conditions ever—particularly fashion retailers. Depleted revenue, compressed margins, and an overburdened fulfillment infrastructure that wasn’t prepared for spikes in online volume reaching 40-60% of total sales are just the tip of the iceberg. Some are seeing up to 8 percentage points of margin loss on a digital order.

Needless to say, the immediate future of fashion retailing may be a bumpy ride.

It was logical to assume sales figures would rebound as vaccinated shoppers grew more comfortable venturing back to the local mall. But that early optimism was quickly tempered by a slew of emerging factors—port shutdowns in China and other nagging supply chain woes, a global labor shortage, and rising inflation—capped off by rippling effects from the Ukraine conflict. The result is a paradox: clothing and clothing accessory sales are on a significant rebound—up 124% from the pandemic depths of March 2020 and 14% above March 2019 levels. Yet record levels of inflation may eventually temper customer buying, especially for discretionary items such as clothing.

In light of all these lingering uncertainties, retailers must be as nimble as ever in their forecasting, planning, and inventory management. Omnichannel is here to stay; that is certain. Even when life feels nearly back to the “old normal,” retailing challenges will continue to evolve. And therein lies the balancing act—successfully coordinating the digital front end with fulfillment from physical inventory. For example, 40% of retail winners have already indicated that “too many inventory transfers between selling locations” was a top inventory management challenge.

So Now What?

Retailers must anticipate and respond to customer demand and market shifts, even though it has become more complicated. It’s not surprising that fewer than 10% of retailers can do this today—but it does explain why 57% of retailers have listed improving demand forecasting a top focus area.

But that is only the start as retailers must reconfigure their assortments for their stores and channels. In an omnichannel environment, the brick-and-mortar store represents a showroom and experience center, along with a convenient sales, fulfillment, and return location. Stores in isolation do not maximize the brand, revenue, or margins. So, even though fringe sizes may have a 10-15% greater demand online, some of this inventory should be carried at stores for fulfillment, even if it isn’t on display.

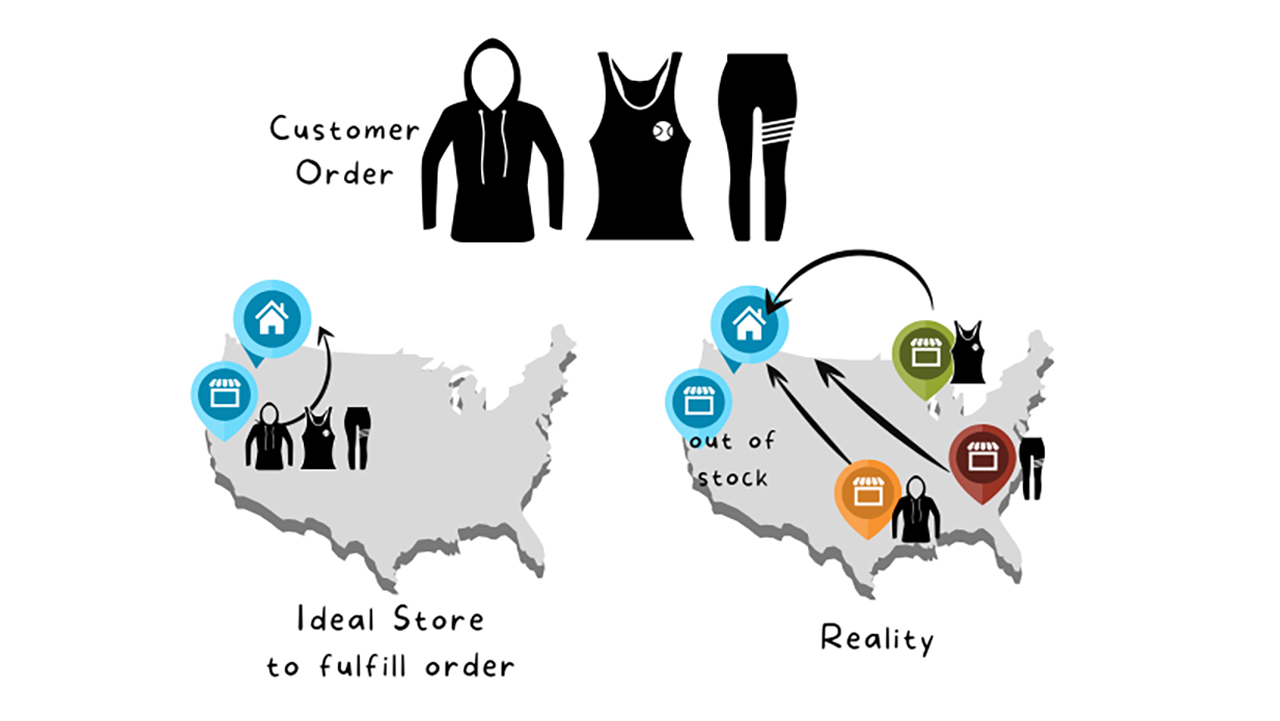

That same type of diligence must be carried through other inventory management processes. Allocation and pricing teams must consider omnichannel demand when making inventory and pricing decisions. How much is going to be picked up from the store, shipped from store, or even returned to the store? The demand is there, whether you plan for it or not. If you don’t plan for it, the following situation can occur.

And finally, fulfillment. Improving the upstream processes will increase profitability through markdown reductions, sell-through gains, and lower shipping costs. Yet profitable fulfillment decisions are needed. Traditionally, these focus only on cost, and not opportunity. Imagine a customer purchases running shoes online for $100 and requests 2-day shipping.

You have two stores (Store A and Store B) that can fulfill the order, and the shoes are priced at $100 at both locations.

Both stores can meet the fulfillment request timeline.

But at Store B, it will cost you $3 more to ship.

Decision made. Go with the lower cost at Store A.

But that quick decision ignores the extended opportunity of those shoes. What if you knew that to sell through all your inventory at Store A would require an average discount of 20%, but Store B would require a discount of 40%. Now Store B is a significantly better option.

Increasing profitability for omnichannel requires rethinking and retooling merchandising and supply chain operations. The previous examples each improve margins through better inventory utilization and lowered shipping costs. However, there is a cascading effect. Each improvement builds upon one another from planning, to allocation, to pricing, and thru fulfillment, starting over again at planning, creating positive momentum with each cycle.

This is proof.

###

Related Read:

Retailers: This is the Truth about True Demand

Mark Schwans

Mark Schwans leads antuit.ai’s product and content marketing for Zebra. Mark has more than 20+ years of experience creating value and change for the retail, CPG, and software industry.

He has held a variety of leadership roles across solution strategy, marketing, business development, project management, consulting, and research and development.

Previously, Mark served as Senior Director for Revionics/Aptos solution marketing and Director for Oracle Retail Solution Strategy for their Merchandising, Allocation, and Pricing solution.

Zebra Developer Blog

Zebra Developer BlogZebra Developer Blog

Are you a Zebra Developer? Find more technical discussions on our Developer Portal blog.

Zebra Story Hub

Zebra Story HubZebra Story Hub

Looking for more expert insights? Visit the Zebra Story Hub for more interviews, news, and industry trend analysis.

Search the Blog

Search the BlogSearch the Blog

Use the below link to search all of our blog posts.

Most Recent

Legal Terms of Use Privacy Policy Supply Chain Transparency

ZEBRA and the stylized Zebra head are trademarks of Zebra Technologies Corp., registered in many jurisdictions worldwide. All other trademarks are the property of their respective owners. ©2025 Zebra Technologies Corp. and/or its affiliates.